tax shield formula cca

Tax Shield Formula Tax Shield refers to the deduction allowed on the taxable income that eventually results in the reduction of taxes owed to the government. It is 0320000004010410501101 57273.

The Tax Shield Approach Assuming That The Capital Chegg Com

Investment Cost Marginal Rate of Income tax Rate of Capital Cost Allowance xl ry Rate of Return Alffilfftq x 1 Rate of Return MAXIMIJM CAPITAL COST ALLOWANCE RATES FOR SELECTED CLASSES.

. If you see closely you will get to know the difference is all three tax rates. Its formula examples and calculation with practical examples𝐖𝐡𝐚𝐭 𝐢𝐬 𝐓𝐚𝐱 𝐒. Here we discuss how to calculate Tax Shield along with practical examples.

Formula to Calculate Tax Shield Depreciation Interest Tax Shield Formula Sum of Tax-Deductible Expenses Tax rate. The intuition here is that the company has an 800000 reduction in taxable income since the interest expense is deductible. K discount rate or time value of money.

For example if an individual has 2000 as mortgage interest with a tax rate of 10 then the tax shield approach will be worth 200. Horizon Blue Cross and Blue Shield and other health care insurers out of more than 688000 by. 1 where UCC is the change in the undepreciated capital cost of the asset class due to the disposition of the asset.

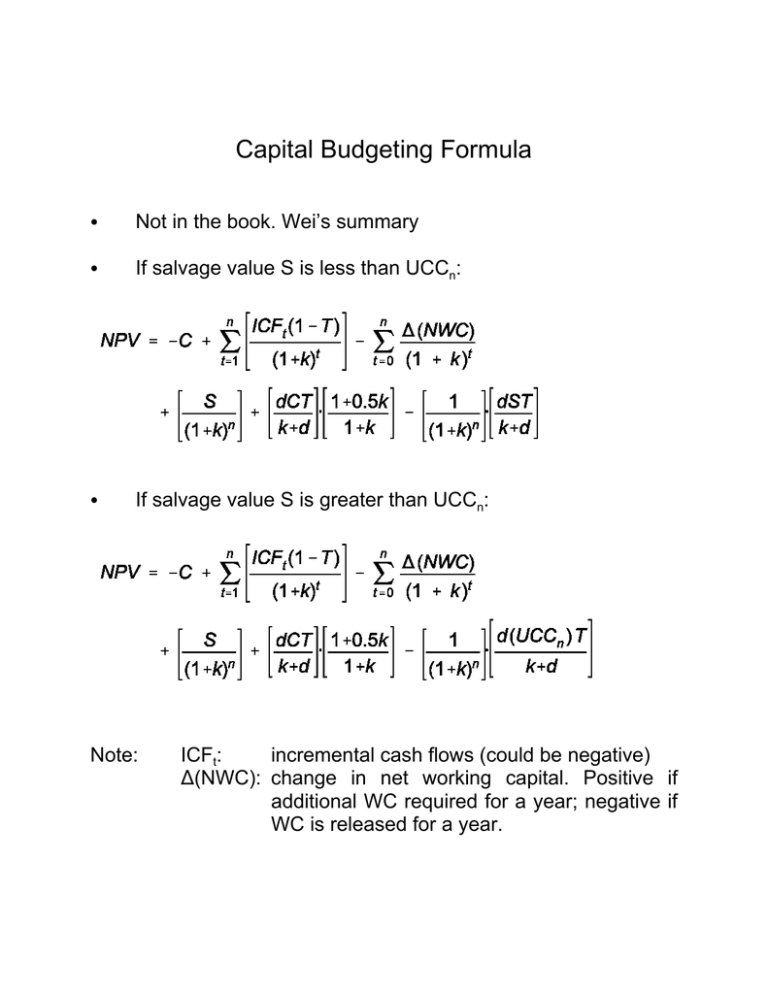

Interest Tax Shield Interest Expense Tax Rate. T corporate tax rate. PRESENT VALUE OF TAX SHIELD FOR AMORTIZABLE ASSETS Present value of total tax shield from CCA for a new asset acquired after November 20 2018 𝐶𝑑𝑇 𝑑𝑘 115𝑘 1𝑘 Notation for above formula.

So using as the discount rate. 6 The last item is the tax shield adjustment. CCA Tax shield calculation CCATS CTD 2 K D 2 K 1 K ATCD Lost Tax Shield FV STD K D N PMT 0 I WACC CPT PV Heading centered assets and liabilities shareholders equity ATCD Indend everything under every category Blank lines.

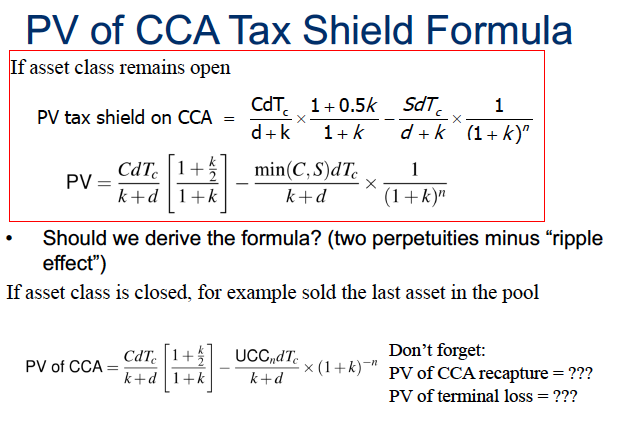

This is a guide to Tax Shield Formula. Salvage PVCCATS The closed-form formula for the Present Value of CCA Tax Shield is SydT rd 1r 1r d PVCCATS where d is the CCA rate of the capital class SN is the salvage value of the capital asset at year N. There it becomes another important and common tax shield approach for the firms.

As such the shield is 8000000 x 10 x 35 280000. It is calculated by adding the different tax-deductible expenses and then multiplying the result by. C net initial investment T corporate tax rate k discount rate or time value of money d maximum rate of capital cost allowance 2.

The tax rate on every bracket is the statutory tax rate. Present value of total tax shield from CCA for a new asset acquired after November 20 2018. Effective Tax Rate 1967.

Year Beginning UCC CCA Ending UCC 1 2 3 the tax shields are just CCA multiplied by the corporate tax rate. PV of CCA tax shield CdTc k d 105k 1k UCCdTc k d 1k n. Based on the information do the calculation of the tax shield enjoyed by the company.

The incremental tax rate 15 on 28625 and 25. Tax Shield Sum of Tax-Deductible Expenses Tax rate. The value of a tax shield can be calculated as the total amount of the taxable interest expense multiplied by the tax rate.

A tax shield is the future tax saving attribute of tax by determining the firms present value and helps to predict the deductibility of a particular expenditure in the profit loss account. Gianetti also pleaded guilty to tax evasion admitting that he failed to file US. Consider the following formula for the present value of CCA tax shields.

Income tax returns for tax years 2000 2001 and 2002 and failed to pay more than 330000 of taxes due on. Discountedcashflows Year ProjectA ProjectB ProjectC ProjectD ProjectE ProjectF ProjectG. C net initial investment.

In this video on Tax Shield we are going to learn what is tax shield. SELECTED PRESCRIBED AUTOMOBILE AMOUNTS 2017 2018 Maximum depreciable cost - Class 101 30000 sales tax 30000 sales tax. Capital Gains Tax If the asset is sold for an amount greater than its initial cost a capital gain is said to occur.

Google company has an annual depreciation of 10000 and the rate of tax is set at 20 the tax savings for the period is 2000. Tax Shield Value of Tax-Deductible Expense x Tax Rate. View Notes - End_of_chapter_Problems from MANAGEMENT MGTB09 at University of Toronto.

How to calculate PV of CCA tax shield. Note the summations are missing the CCA tax shields beyond year 20 and are thus slightly lower than the true amounts calculated with the PVCCA tax shields formula. SELECTED PRESCRIBED AUTOMOBILE AMOUNTS.

T corporate tax rate. The effects of the tax shield approach must be used in cash flow analyses since the amount of cash paid is impacted. 9 now incorporate the half year rule.

When we calculate item 5 we assume. Note that the following formula above is only applicable for. This is equivalent to the 800000 interest expense multiplied by 35.

The Tax-Shield Approach assuming that the capital class remains open. D maximum rate of capital cost allowance. Calculating the tax shield can be simplified by using this formula.

K discount rate or time value of money. TABLE III A FORMULA FOR CALCULATING THE PRESENT VALUE OF REDUCTIONS IN TAX PAYABLE DUE TO CAPITAL COST ALLOWAICE. Present value of Total Tax Shield from CCA for a New Asset Notation for above formula.

Assume for the moment that you keep the asset forever and ignore the half year rule we have. D maximum rate of capital cost allowance. Actual sentence based upon a formula that takes into.

C net initial investment. For instance if the tax rate is 210 and the company has 1m of interest expense the tax shield value of the interest expense is 210k 210 x 1m. We have a positive sign in front of it since this is tax savings.

Effective Tax Rate 1573875 80000. This reduces the tax it needs to pay by 280000. The following is the Sum of Tax-deductible Expenses Therefore the calculation of Tax Shield is as follows Tax Shield Formula 10000 18000 2000 40.

5 The fifth item is the PV of all the future tax shields from CCA assuming the equipment will last forever under the half-year rule. 1𝑘 Notation for above formula.

Tax Shield Formula How To Calculate Tax Shield With Example

Fin 300 Lecture Notes Fall 2016 Lecture 9 Capital Cost Allowance Tax Shield Tax Rate

Present Value Of Tax Shield On Cca Evaluation And Computations In Corporate Finance Lecture Slides Docsity

Tax Shield Formula Step By Step Calculation With Examples

Fina 2710 Textbook Notes Summer 2019 Chapter 9 Tax Shield Net Present Value Working Capital

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula How To Calculate Tax Shield With Example

The Mechanics Of Pv Ccats Calculation Ppt Download

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Step By Step Calculation With Examples

10 0 Capital Cost Allowance Cca Cca Is Depreciation For Tax Purposes The Depreciation Expense Used For Capital Budgeting Should Be Calculated According Ppt Download

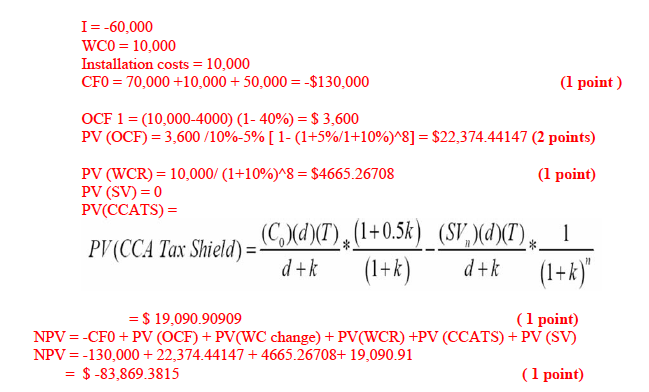

Q 4 6 Points Tax Shield Inc Is Considering A New Chegg Com

Formula Jpg Pv Of Cca Tax Shield Formula Pv Tax Shield On Cca Cch X 0 S X 1 D K L K D K 1 17c L Where C Cost Of Asset D

Acc 372 Solutions To Problem Set 2

Solved An Asset Has An Installed Cost Of 1 Million A Life Of 8 Years A Cca Rate Of 30 And A Salvage Value Of 50 000 What Is The Relevant Pre Course Hero